In a recently published paper in the One Ecosystem Journal by MAIA’s partner David Barton from the Norwegian Institute for Nature Research (NINA), it is argued that when simulating markets to create exchange values where none previously existed and when conducting value generalisation, which extrapolates exchange values from particular sites to the entire accounting area, monetary valuation of ecosystem services for ecosystem accounting needs to be sensitive to institutional context.

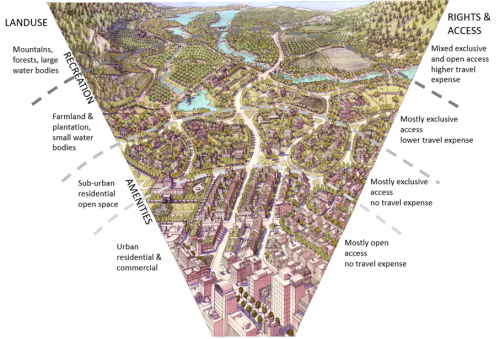

The paper also exemplifies that an ecosystem service will not have a single price if costs of supply and transaction vary in space. It does it for different institutional settings for exchange values of recreation services exploring the general recommendation in SEEA EA for making valuation methods sensitive to institutional context.

Through reviews of non-market stated preference valuation studies that have been sensitive to institutional design, the author found out that institutional design is specifically relevant for simulation of market exchange values for the purpose of compiling monetary ecosystem accounts.

In conclusion, disregard for the institutional context in valuation for ecosystem accounting can lead to: (i) errors of generalisation/aggregation and (ii) downward ‘bias’ in simulated accounting prices (relative to the status quo of the institutional context).

Read the full paper here.